Dragons' Dens & Shark Tanks: Dark Financial Traps Inside Managed Demolition

Another of GloboCap's strategies of controlling the narrative: debt-to-equity ratio

Over the years I’ve learned lots about Propaganda Theory and how GloboCap controls the narrative through censorship and controlled opposition. That grip, I’ve now realised, could be a lot tighter than I’d realised. “There be dragons!”

Dragons’ Den was a reality TV series where entrepreneurs pitch their unique business ideas to a panel of wealthy venture capitalists. These investors may or may not offer funding in return for equity. Seemed like a bit of fun to watch at the time and it grew in popularity worldwide.

In the US, the IP was used for the same series, appropriately branded Shark Tank - as it was too in Australia, and Portugal. In Germany it was named Lions’ Den. It’s been argued that the use of these mythical and/or dangerous creatures is because investment is predatory: exploitation (of Intellectual Property, for instance), has been rebranded as (ethical?) ‘capitalising’. would perhaps like to comment on that topic?

I was familiar with this concept: the investor provides the funding needed, in exchange for a share of the equity/profits. Seems like a reasonable long term gamble, if due diligence is undertaken (more on that another day). That’s partly what made the ‘follow up’ episodes so interesting: some projects failed, others (perhaps most famously, Levi Roots’ Reggae Reggae Sauce) achieved amazing success.

Q: But what about when one of these ‘predators’ is a hostile shareholder?

And I’m not referring to a takeover like Elon did with Twitter or mergers like Gates did to grow Microsoft. I’m referring to deliberate managed demolition. Obviously they don’t teach you about this dark strategy in any MBA. This question is partly what motivated Steven Howard from Mindwars - Ghosted and I to co-author (with strategic help with AI) our recent six-part fictional story about ‘George and the Philanthropath’:

Why must we learn their evil methods?

In order to ‘win’ we must grow our knowledge and understanding of the practical ways these corrupt mechanisms are enacted. How do they work, and what/who drives them? We need specific case-study examples (especially imagined ones, like George’s) to disentangle, to learn how events like a managed demolition happen. And along those lines, I’ve written at length about my own sector: the various ways that our universities are manipulated. These mechanisms in turn silence dissent (through gagging clauses for example) and dictate what is published in peer-reviewed journals and other outlets. This obfuscates or bends truth and steers policy decisions, for instance:

There’s also the Fake Fact-Checkers that so many universities are (tragically) an intrinsic part of. So I want to turn to an unfamiliar topic (for me): company finances. And the question posed is how exactly could a commercial entity, on the surface at least appearing to be operating in a ‘free-market’ economy, be manipulated to support The Narrative in the same ways our public sectors are? In part, I’ve already written about this topic, outlining how the Government (in this case, in NZ) can dictate private companies’ policies, because of (e.g. tax) benefits those companies gain. For example, during the covid era, here:

So, what about the same scenario, but a private entity firm which is ‘on our page’? For example, private companies in theory should be fully dependent upon levels of their own customers’ support, which provides them with financial sustainability through selling their products/services, right? As paying subscribers, or shoppers, we are ultimately the shareholders - responsible for the success and long-term viability of any Freedom-Fighting platform or group. Perhaps not.

Corporate Financial Jargon

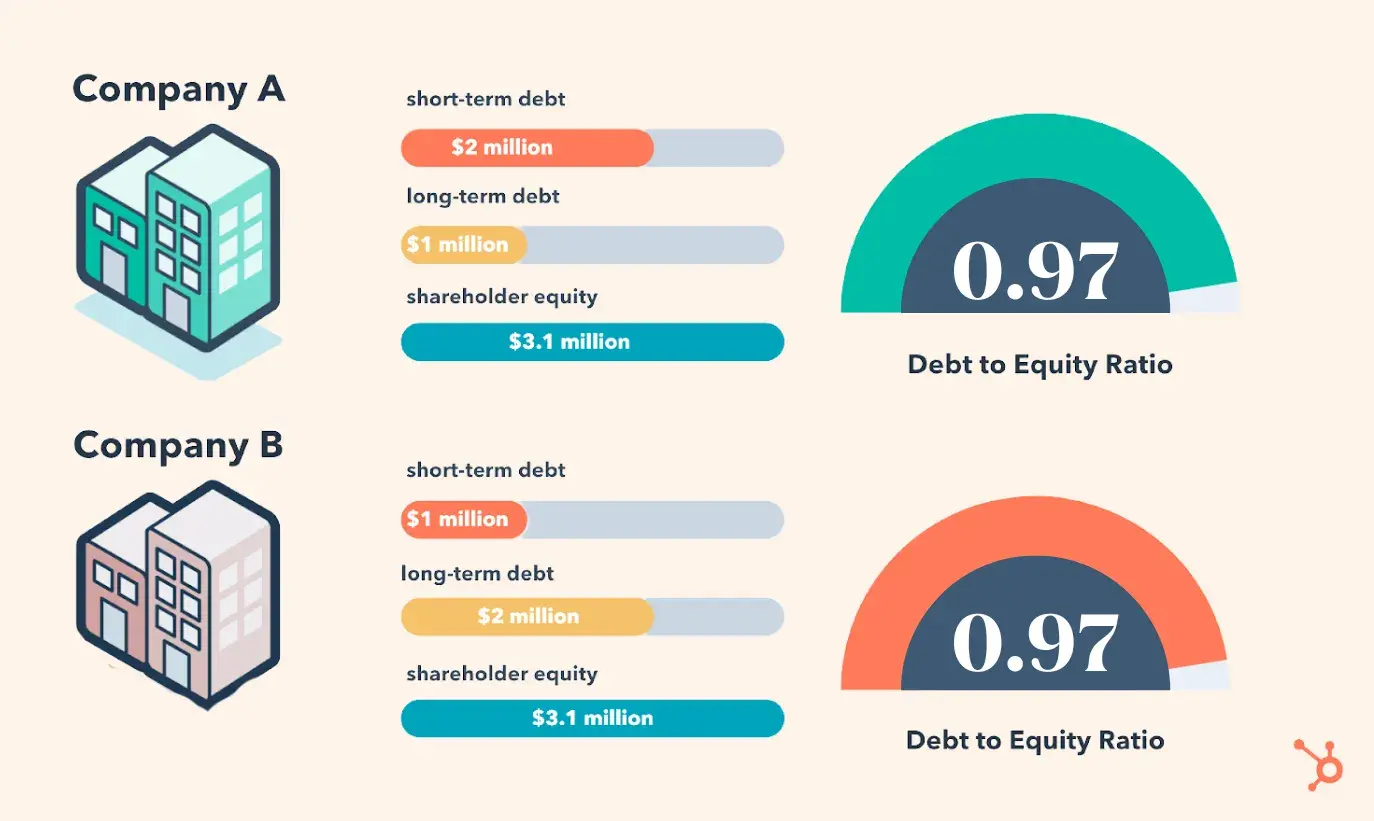

In this American article, a Tax Advisor tackles the complex topic of ensuring that shareholders’ debt is not reclassified as equity. Without boring my readers too much (I admit, it took some considerable commitment to get to grips with this issue), difficulties arise when the ratio of debt calculated to fair market value is deemed ‘excessive’, depending on things like norms in certain retail/service sectors.

Importantly, it is well-established, not only in US caselaw, that corporate debt owed to shareholders MIGHT be re/defined as equity. Interestingly, in Luxembourg Courts, a change was decided this year, which tightens-up previous legislation regarding companies’ benefitting from interest-free-loans (IFLs). What does this mean in practice?

“IFLs granted by (indirect) shareholders to a Luxembourg company may be reclassified as hidden equity contributions for tax purposes {…} AND the debt-to-equity ratio of a Luxembourg company must be assessed on a case-by-case basis and be documented appropriately from a transfer pricing perspective.” [source]

In other words, rather than a ‘donation’, IFLs may be defined as a taxable dividend and could therefore impact on the value of a company.

Freedom Fighting vs Commercial Viability

Equity and profit sharing means investors expect returns through dividends or capital gains. But is this realistic when we are ‘selling freedom’? Where is the profit margin and how can sales be ethical? The longer this silent war continues, and the deeper the global recession digs in, the harder it’s going to be to maintain financial viability. Because if there is a high debt-to-equity (D/E) ratio, financial risk can lead to:

- Defaulting: during economic downturns, repayments maybe difficult/impossible.

- Cash flow strain: Debt payments put pressure cash flow which limits (essential) maintenance/growth.

- Higher borrowing costs: Interest rates may increase if risk goes up, or even stop additional lines of credit altogether.

- Contract violations: These might trigger immediate repayment, which could mean bankruptcy.

Management Conflict

When founders and existing shareholders unwittingly lose control and decision-making power, tensions result that could result in changes in the company’s goals and direction. When a contract is entered into in ‘good faith’ (as George’s was in our story) then any ‘interest free loan’ is usually seen as a long-term debt (as per above image). But then, when things go wrong (either deliberately, or not), contract violations could mean that loan becomes instantly repayable, and without adequate back-up plans, or access to equity, the result could be devastating. For the freedom fighting company, and for all of us.

What lesson can be learned from this case study? If you’re in the Dragons’ Den, always do due diligence, and trust your gut instinct. Our fictional character, George, knew instinctively that his offer of an interest-free loan from Corvina (the Cruella deVil character) was too good to be true. But ego is a strong force, he went ahead anyway, and the rest, as they say, is history.

You can Buy Me a Christmas Coffee here - cheers! I’ll pay it forward.